Why event-driven trade ideas are a game changer for brokers

In trading, speed is everything. Market prices react to news and events in minutes, and traders who don’t act quickly risk missing out on opportunities. That’s where Trading Bull excels. Unlike traditional news providers or signal services, Trading Bull combines speed with relevance, delivering event-driven trade ideas that keep your clients ahead of the market and your brokerage thriving.

What are event-driven trade ideas?

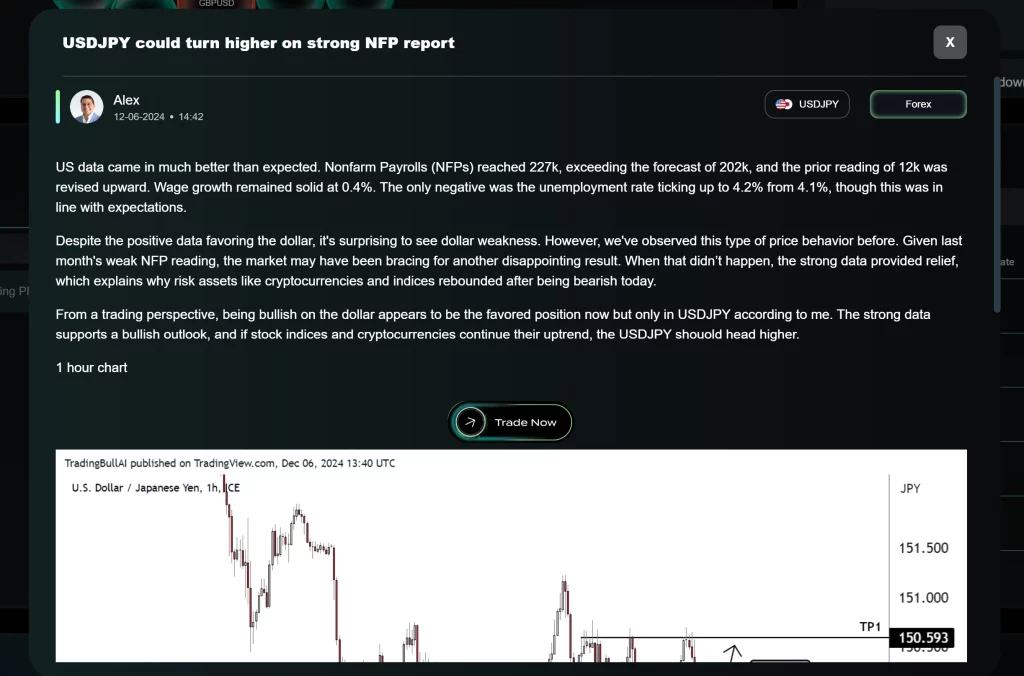

At Trading Bull, we don’t just report news—we turn them into actionable opportunities. For example, Trading Bull acts instantly when a significant event like Non-Farm Payrolls (NFP) is released.

Step 1: After the data is published, we publish the NFP outcome directly inside your platform. Clients don’t need to switch to third-party sources. The content is translated into multiple languages for global accessibility.

Step 2: Minutes after the data release, we produce the first trade idea: a combination of fundamental and technical analysis, complete with a Trade Now button. Each trade idea includes:

- Context explaining why we are bullish or bearish.

- Clear instructions on how to turn the event into a trade.

This process typically takes less than 10 minutes, allowing traders to capitalise on the information arbitrage created by the event.

Step 3: For high-impact events like NFP, we don’t stop at one update. Within 20 minutes, we typically produce 3 to 4 actionable trade ideas, capturing different angles of the market reaction.

Our methodology focuses on aligning event data with price action. For instance, if data is bullish for an instrument and price simultaneously triggers a bullish technical pattern, we prioritise this scenario. In contrast, if the data contradicts the market trend, we approach it cautiously or don’t report on it.

Why event-driven trade ideas work better for client engagement

Event-driven trade ideas are powerful because they must be acted upon immediately. If traders wait too long, the information arbitrage disappears. This creates urgency and excitement, driving traders to act swiftly.

Moreover, combining event data with technical analysis creates more confidence in executing the trade vs. static trade ideas or depending on news alone.

For brokers, this means higher client engagement, increased trading volumes, improved retention rates, and re-deposits—a win-win scenario.

Seamless integration with FX and CFD brokers

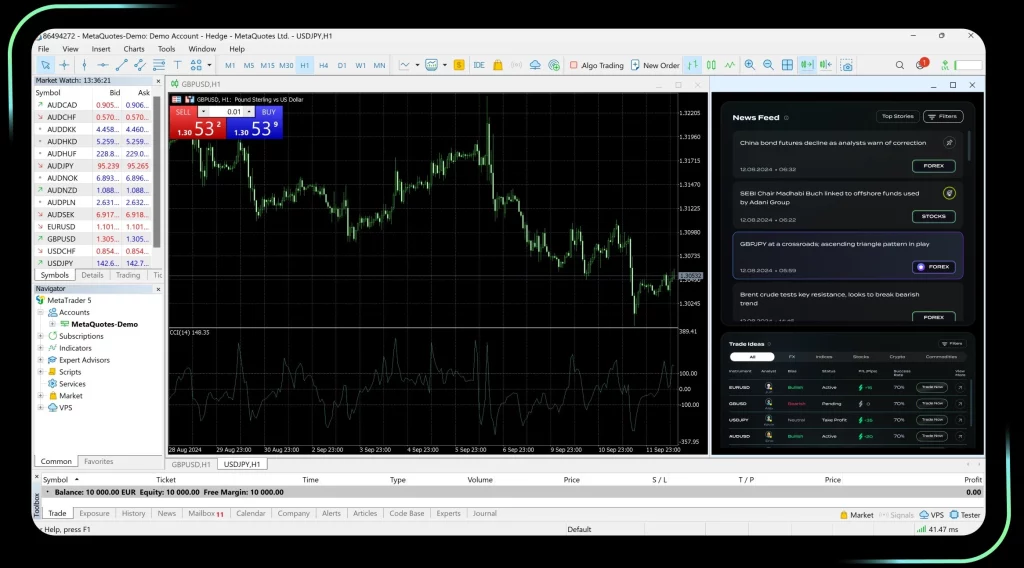

Trading Bull integrates effortlessly with broker platforms through multiple channels, ensuring flexibility and efficiency:

- MetaTrader EA: Direct integration via a MetaTrader Expert Advisor.

- cTrader Algo: Seamless connection via a cTrader’s Algo plugin.

- API for custom apps: Tailor-made integrations for proprietary platforms and applications.

- Widget on Client Portal: Easy-to-embed widgets for real-time trade ideas directly on broker portals.

- Telegram Bot: Instant notifications and actionable trade ideas are delivered to the Telegram bot.

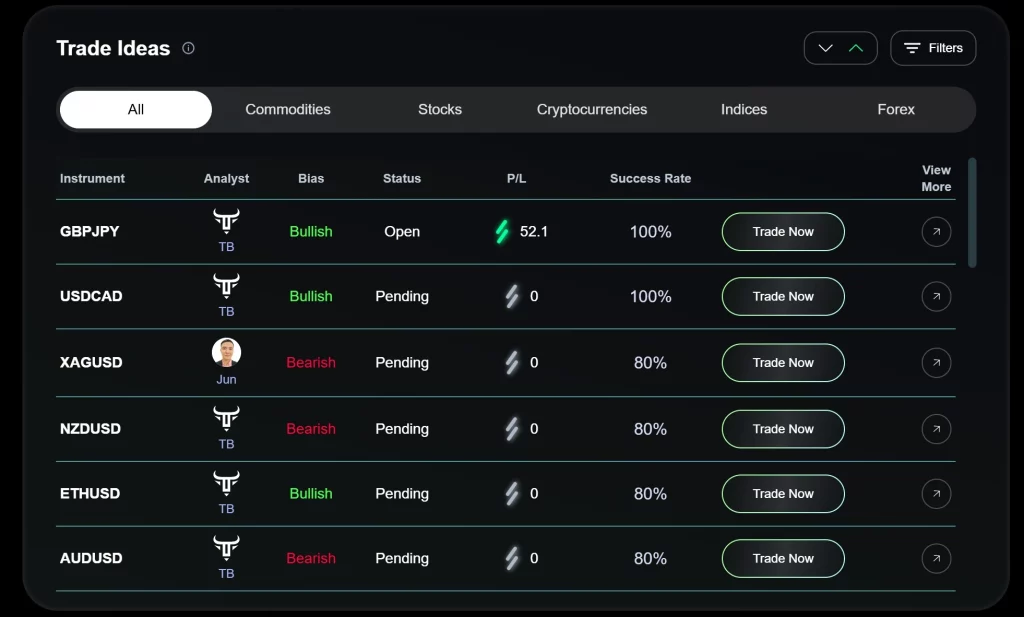

Why Trust Trading Bull?

Transparency sets us apart. Unlike other providers, we publish win rates by analysts and the market. Every time you receive an update, you’ll know if the analyst’s current performance aligns with the market conditions. No other service offers this level of accountability and insight.

Discover how Trading Bull’s event-driven trade ideas can transform your business and keep your clients ahead of the market. Contact us today.

Get a

free demo

[gravityform id=”4″ title=”true”]

Unlock Trading Bull’s potential with a tailored demo. Kindly note, we respond exclusively to professional work email addresses.